Hello there, this is your pilot speaking! (Why yes, I am calling myself a pilot.)

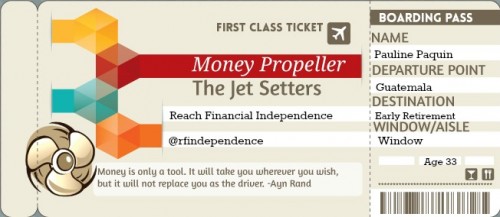

Today, our Jet Setter Interview is with Pauline, of Reach Financial Independence, Make Money Your Way and Savvy Scot

This series covers Passengers on the Jet Setter Manifest, so we can all learn more about money from the experiences of others.

Drop me a line to be featured in an upcoming Jet Setter Interview, we would love to have you on board.

Welcome on board! Who are you?

My name is Pauline, I am 33 and originally from Paris, France. I blog over at Reach Financial Independence where I talk about deliberate living, reaching your own goals, and life in Guatemala, my new home country.

Money is for buying stuff, what was the last purchase you made?

About a week ago I came back home and bought 50lb of corn for my chickens, and some fruits vegetables for myself. I don’t spend money when I am home, except for workers’ salaries and buying internet credit on my phone.

The last expense that was not food or gas was $15 for a brushing, festive hairdo and gel manicure as I was attending a wedding.

The last “stuff” was a bunch of books for the local school in my village and new tyres for my car.

Why did you buy that stuff, in particular?

I buy very few things, and actually had to think hard to remember the last thing I bought. Whatever I buy is important to me, or needed to make my life better. I bought the tyres because I didn’t feel safe driving any more with the old ones.

We like airplanes around here. When was the last time you were on an airplane and where were you going?

The last flight was back in February when I came back from two weeks in Miami to Guatemala. Can’t believe I haven’t flown in six months, when I lived in Europe I used to fly once or twice a week, but don’t miss it at all, on the contrary, I am a rather bad flyer.

What is your current financial goal and how did it come to be your goal?

One of my goals this year is to make $60,000 blogging. I live on around $1,000 a month in Guatemala, with staff, in a paid for house. But $5,000 a month is a point where I can travel whenever I want, buy whatever I want and still save a bit in case I want to make an even bigger purchase, without touching my savings.

Who is your favourite person in Top Gun?

Sorry I’ll have to pass! Not a big Top Gun fan, but I like “Take my breath away”.

Many people harbour some sort of fear of flying. What do you find the most overwhelming or scary about money?

I’d rather face money than flying! Money has never scared me, as I have always worked and saved from a young age. But when I was 10 or so my dad lost his job and they made a bit too much drama around it, so I thought we would get thrown out in the streets, I was really worried. That’s why I was always a saver I think, to weather all the storms no matter what.

If I was super-rich and gave you $50,000 with no strings attached, tomorrow, what would you do with it? (I’m pretty benevolent.)

Well I would take you out to dinner to say thank you. Then I would probably up my offer on that piece of land I have had my eyes on for a couple of months, and start building a house on it. It has wonderful views over the Guatemalan volcanoes.

Lots of things “cost peanuts,” what is a small expenditure that you just can’t live without?

My internet connection, as it is my link to my friends, family and livelihood. It costs $2 every other day, as we don’t have a landline so I need to top it up as I go.

How long have you been the pilot of your own money? Did you have a job as a teenager? Did you have a lightbulb moment at a certain point in time and take control of your finances?

For as long as I can remember. When I was 10 or so, I started baby-sitting my cousins. As a teen, I was a tutor to younger kids every night after school and gave piano lessons in the music room at lunch time. I hustled on the weekends with my Scout troop packing groceries or Christmas presents so we could afford the summer trip.

Compared to my friends’ allowance, I had a lot of money but I also knew the hard work behind earning it, so I rarely bought crazy things.

I had a lightbulb moment after college that if I kept that high earning/high saving road for a while more, I could either stop working for extended periods of time (which I did to travel around the world for a year), or leave the workforce decades before everyone else, which I did at 29.

Pretend you have a sky-writing airplane (that can write as many words as you want.) What is the main money message that you want the world to hear?

Get started!

If you are 20, you have time on your side as a huge asset to build wealth, so start saving now. If you are 50 and have no savings, it is not too late, and getting started now will always be better than tomorrow.

Thanks for joining us today, Pauline! You can check her at Reach Financial Independence and you connect with her on twitter@rfindependence and on Facebook.

I’m always interested in the family stories behind how people view and manage their money today. Even though you were probably worried as child when your Dad lost his job, it doesn’t seem like it had too much of a detrimental effect on you. In fact, quite the contrary. Thanks for sharing, Pauline.

debs @ debtdebs recently posted…55 Reasons it’s Okay To Be 55

Another great interview. $1000 a month isn’t bad with all the support staff but $5000 a month is definitely good money in 90% of the world. Keep it up and good luck Pauline.

I can’t believe I haven’t discovered these interviews until now. This is an amazing set of insights to get from Pauline 🙂

Mario recently posted…Ten things you should always buy generic

Thanks Mario!

Pauline recently posted…How to survive a breakup financially

Great interview! It’s nice to get to know you better, Pauline! I’m super impressed with your goal of making $60K through blogging this year–wow. Teach me your ways!! 🙂

Mrs. Frugalwoods recently posted…Should Our UK Reader Pay Off Her Mortgage?

It is a mix of hard work, luck and more luck! I made almost nothing for the first six months then readership grew, and having three sites help too.

Pauline recently posted…The day my roommates paid for my apartment